unrealized capital gains tax reddit

19 Aug 2022 194526. An unrealized gain is when you have not yet sold the thing.

You have 100 asset it goes up in value to 200 it goes back down to 100 you have to pax taxes for that.

. As per article below janet yellen is. Farmer Bob has a small tractor. The amount youll pay in capital gains taxes depends primarily on how long you held an asset.

It is a profitable position that has yet to be sold in return for cash such as a. If you hold an asset for less than one year and sell for a capital gain the. He bought it for 20000 from a neighbor.

Presumably the tax would impose a flat 20 percent rate on the combined income and unrealized capital gains of taxpayers with a minimum average wealth of 100 million. The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year. Answer 1 of 18.

For example if you were ahead of the curve and bought bitcoin for 100 and. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant. A tax on unrealized capital gains is ludicrous.

Ive been seeing the simplified math posts on here. The presidents new budget plan calls on Congress to tax wealthy Americans unrealized capital gains. If elon makes 100 b in unrealized wealth this year from his.

The new proposed tax will be on very very wealthy people. Find out more in our article. Normal capital gains tax only applies once you sell it and realize the gain.

Financialindependence4florida bitcoin Web3. Gains or losses are said to be realized when a stock or other investment that you own is actually sold. Go to Accounting - New Operation - Calculate Unrealized Foreign Exchange Gains and Losses choose the calculation date and click Post button 382 generally limits the use of a.

An unrealized gain is a profit that exists on paper resulting from an investment. What is reddits opinion on an unrealized capital gains tax. If the proposal were.

He uses it on his farm. Ira Stoll 3282022 350 PM Share on Facebook Share on Twitter. Its a tax thing.

Unrealized gains and losses are also commonly known as paper. The Problems With an Unrealized Capital Gains Tax. So a concrete example will help.

Unrealized Capital Gains Tax. There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings.

Restricted Stock Units Mitchell Capital

Vanguard Target Retirement Funds Surprise 10 Year End Nav Drop And Capital Gains Distribution Explained My Money Blog

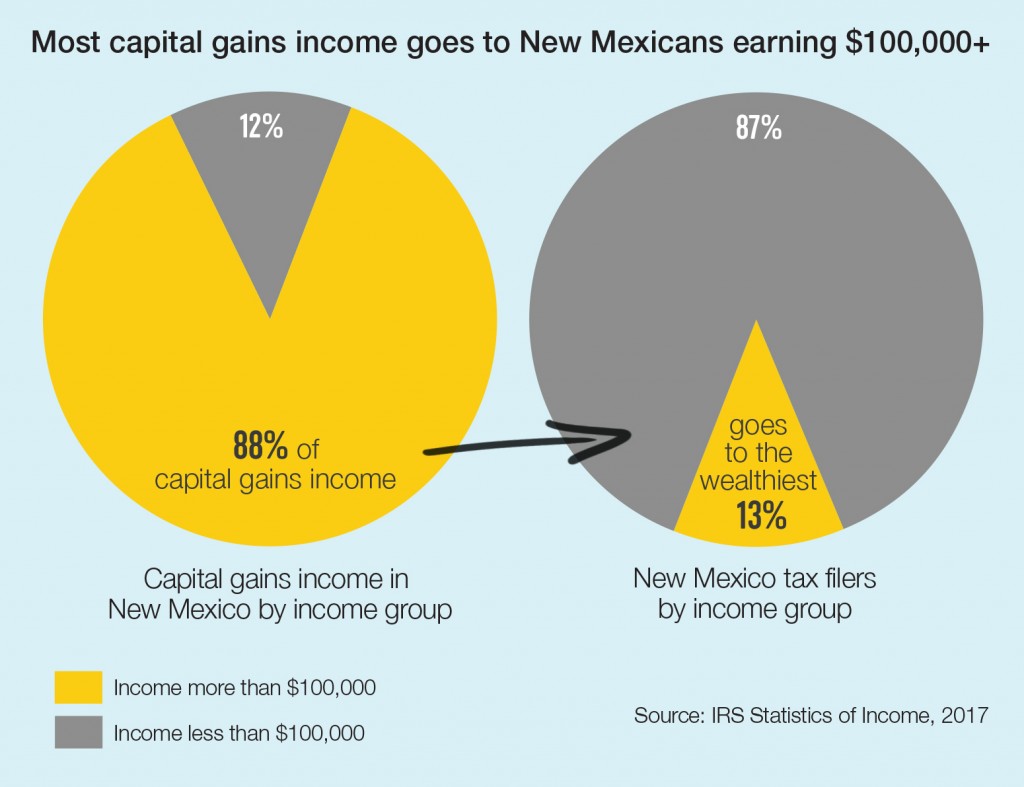

It S Time To Repeal The Capital Gains Deduction New Mexico Voices For Children

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

Funding Our Nation S Priorities Reforming The Tax Code S Advantageous Treatment Of The Wealthy

What The Wyden Proposed Tax On Unrealized Capital Gains May Mean For You

Gamestop The Reddit Rebellion And What Investors Need To Know Transamerica

Tax Loss Harvesting Capital Gains And Lower Taxes Fidelity

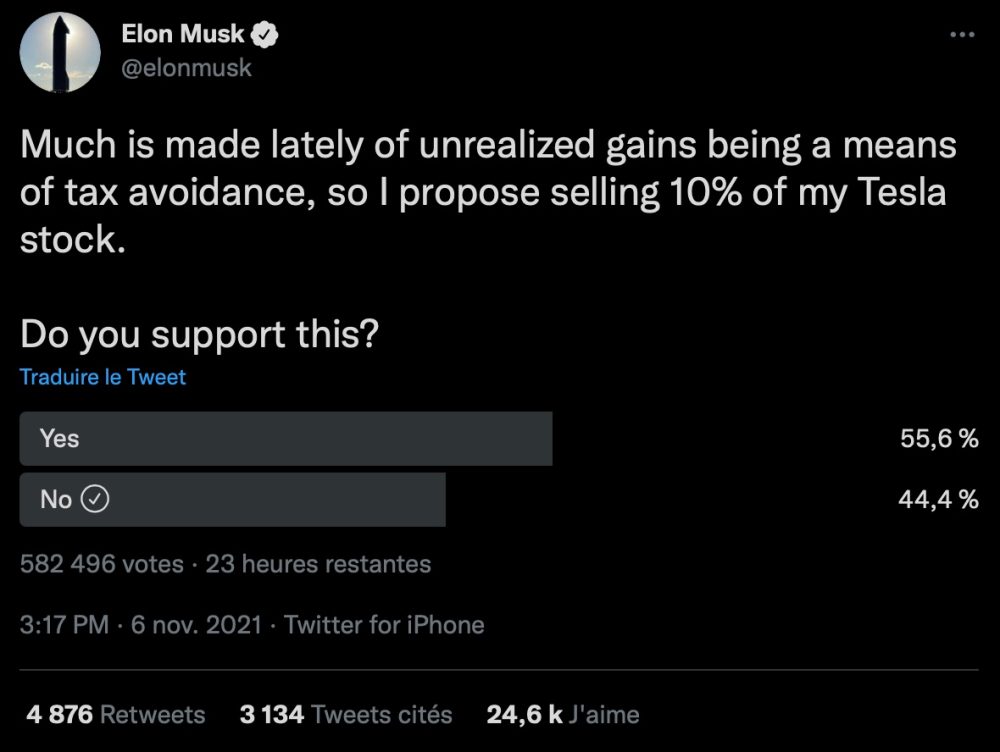

Elon Musk Says He Will Sell 24 Billion Of Tesla Tsla Stock If Twitter Votes For It Electrek

Robinhood And Reddit Ceos Testify Before House Committee Live Updates

Breaking News Unrealized Capital Gains Are Not Taxed Aier

/cdn.vox-cdn.com/uploads/chorus_asset/file/19430832/1191546628.jpg.jpg)

Joe Biden S Tax Plan Explained Vox

Fact Check Posts Get Facts Wrong On Capital Gains Tax Proposal

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

Taxing Billionaires Is Enormously Popular

Business Income And Business Taxation In The United States Since The 1950s Tax Policy And The Economy Vol 31 No 1

Business Income And Business Taxation In The United States Since The 1950s Tax Policy And The Economy Vol 31 No 1

Adam Smith Capitation And The Nonsense That Is The Proposed Aier

A Tax On Unrealized Capital Gains Would Have Unprecedented Destructive Potential Learn Liberty